Arizona Online License Renewal Courses Anytime/Anywhere at your fingertips! July 24/30 hrs. Special Package Pricing! |

Forgot Your Password |

|

SALESPERSON'S LICENSE Every course you need to Renew your Arizona License!

These are the 8 courses included in this license renewal package selected by us: |

|

DESIGNATED BROKER & Every course you need to Renew your Arizona License!

These are the 10 courses included in this license renewal package selected by us: |

|

Integrating Fair Housing The objectives of this course is to provide the student with information so they can understand the Arizona and Federal Fair Housing Laws, which would include the protected classes, possible violations and strategies on avoiding them. Other topics include Civil Rights history in the United States, NAR's guidelines, predatory lending, case studies and integrating “diversity-oriented strategies” into the agent's business plan.

Course Documents and Reference Materials In order to pass this class and receive your Educational Certificate, the student must complete all sessions by reading the materials online and completing the quizzes at the end of each session. After all sessions have been completed, the student can then proceed to take their Final Exam, which consists of 25 questions based on the completed sessions. You must pass the Final Exam with a score of 80%, which will indicate that you have read and completed your assignments. You can retake the final until you pass. Once you pass your Final Exam, you can then click on the Certificate Link and

receive your Educational Certificate for 3 hours of credit in Fair Housing Issues. | ||||||||||||||||

|

Fair Housing Today The objective of this course is to provide the student with an understanding of the Fair Housing Act as well as some of the history of Civil Rights in the United States.

In order to pass this class and receive your Educational Certificate, the student must complete all sessions by reading the materials online and completing the quizzes at the end of each session. After all sessions have been completed, the student can then proceed to take their Final Exam, which consists of 25 questions based on the completed sessions. You must pass the Final Exam with a score of 80%, which will indicate that you have read and completed your assignments. You can retake the final until you pass. Once you pass your Final Exam, you can then click on the Certificate Link and

receive your Educational Certificate for 3 hours of credit in Fair Housing Issues. | ||||||||||||||||

|

Disclosure, Risk Management & Case Studies At the conclusion of this course, the student will be able to understand the potential for major risk that impacts every day real estate practice; identify and explain the specific major problem areas that cause risk for real estate licensees; describe the different standards as defined and directed by law, Commissioner’s Rules, and the Code of Ethics of the National Association of REALTORS® that adheres to promotes risk management; more effectively protect themselves from those problems and risk; and dispel common myths and fantasies related to risk and risk management.

Course Documents and Reference Materials In order to pass this class and receive your Educational Certificate, the student must complete all sessions by reading the materials online and completing the quizzes at the end of each session. After all sessions have been completed, the student can then proceed to take their Final Exam, which consists of 25 questions based on the completed sessions. You must pass the Final Exam with a score of 80%, which will indicate that you have read and completed your assignments. You can retake the final until you pass. Once you pass your Final Exam, you can then click on the Certificate Link and

receive your Educational Certificate for 3 hours of credit in Disclosure. | ||||||||||||||||

|

Disclosure Law Overview The objective of this course is for the student to get an overview of disclosure law in Arizona. Areas covered will be material fact disclosures and the licensee's obligations and components that should be used in making those disclosures. ADRE, Arizona Statutes and Court Cases will be referenced as it relates to disclosures. Also reviewed will be natural hazards, disclosure reports and liability for failure to disclose.

In order to pass this class and receive your Educational Certificate, the student must complete all sessions by reading the materials online and completing the quizzes at the end of each session. After all sessions have been completed, the student can then proceed to take their Final Exam, which consists of 25 questions based on the completed sessions. You must pass the Final Exam with a score of 80%, which will indicate that you have read and completed your assignments. You can retake the final until you pass. Once you pass your Final Exam, you can then click on the Certificate Link and

receive your Educational Certificate for 3 hours of credit in Disclosure Law. | ||||||||||||

|

Agency Issues Today At the conclusion of this course the student will be able to understand the representation and agency issues that impact their everyday real estate practice and describe the different types of agencies as defined and directed by law, Commissioner’s Rules and the Code of Ethics of the National Association of REALTORS®. In addition, the student will be able to identify the required agency disclosures and the standard forms and agreements used in the business. Common agency myths will be discussed, as well as effective consulting skills with the consumer.

Course Documents and Reference Materials In order to pass this class and receive your Educational Certificate, the student must complete all sessions by reading the materials online and completing the quizzes at the end of each session. After all sessions have been completed, the student can then proceed to take their Final Exam, which consists of 25 questions based on the completed sessions. You must pass the Final Exam with a score of 80%, which will indicate that you have read and completed your assignments. You can retake the final until you pass. Once you pass your Final Exam, you can then click on the Certificate Link and

receive your Educational Certificate for 3 hours of credit in Agency Law. | ||||||||||||||||

|

Representing the REO/Short Sale Buyer At the conclusion of this course, the student will be able to provide information and guidance to the buyer so the buyer will be informed and protected in making their decision to buy on a short sale or REO transaction. The student will also be able to effectively negotiate on behalf of the buyer/client to obtain the most favorable price and terms for them on short sales and REO transactions and follow up with the buyer/client in the closing and post closing of an REO or short sale transaction.

Course Documents and Reference Materials In order to pass this class and receive your Educational Certificate, the student must complete all sessions by reading the materials online and completing the quizzes at the end of each session. After all sessions have been completed, the student can then proceed to take their Final Exam, which consists of 25 questions based on the completed sessions. You must pass the Final Exam with a score of 80%, which will indicate that you have read and completed your assignments. You can retake the final until you pass. Once you pass your Final Exam, you can then click on the Certificate Link and

receive your Educational Certificate for 3 hours of credit in Agency Law. | ||||||||||||||||

|

Selling Effectively in a Litigious Environment At the conclusion of this course, the student will be able to explain how statutory law and court decisions apply to their obligations to orienting and educating the consumer in a real estate transaction and to advise the consumer on the specific information they will need to an informed decision when buying or selling a property. The student will also be able to recite the applicable laws and standards of practice to their role in representing a buyer or seller in the sale or purchase of a property and to apply the principles of consumer protection to assisting the consumer in their sale and/or purchase of a property. The student will also be more effective in managing and reducing the risks involved in the purchase or sale of a property for both their client and themselves.

Course Documents and Reference Materials In order to pass this class and receive your Educational Certificate, the student must complete all sessions by reading the materials online and completing the quizzes at the end of each session. After all sessions have been completed, the student can then proceed to take their Final Exam, which consists of 25 questions based on the completed sessions. You must pass the Final Exam with a score of 80%, which will indicate that you have read and completed your assignments. You can retake the final until you pass. Once you pass your Final Exam, you can then click on the Certificate Link and

receive your Educational Certificate for 3 hours of credit in Legal Issues. | ||||||||||||||||

|

Contract Writing - Legal Issues The objectives of Contract Writing - Legal Issues is to provide the student with an understanding of Legal Issues relating to drafting contracts. The Buyer Disclosure Advisory is thoroughly reviewed; what makes a contract enforceable; drafting contingencies; taking title; and fixing title issues are discussed.

Course Documents and Reference Materials In order to pass this class and receive your Educational Certificate, the student must complete all sessions by reading the materials online and completing the quizzes at the end of each session. After all sessions have been completed, the student can then proceed to take their Final Exam, which consists of 25 questions based on the completed sessions. You must pass the Final Exam with a score of 80%, which will indicate that you have read and completed your assignments. You can retake the final until you pass. Once you pass your Final Exam, you can then click on the Certificate Link and

receive your Educational Certificate for 3 hours of credit in Legal Issues. | ||||||||||||

|

Essential Contract Terms and Conditions The objective of this course is for the student to identify and understand some of the key terms and conditions that are in most purchases contracts or that should be included in a purchase contract. Areas covered are property and possession issues; financing issues; title and escrow issues; seller /buyer disclosures and warranties; due diligence and inspection disapprovals.

In order to pass this class and receive your Educational Certificate, the student must complete all sessions by reading the materials online and completing the quizzes at the end of each session. After all sessions have been completed, the student can then proceed to take their Final Exam, which consists of 25 questions based on the completed sessions. You must pass the Final Exam with a score of 80%, which will indicate that you have read and completed your assignments. You can retake the final until you pass. Once you pass your Final Exam, you can then click on the Certificate Link and

receive your Educational Certificate for 3 hours of credit in Contract Law. | ||||||||||||

|

Contract Writing - AAR Contract The objectives of Contract Writing - AAR Contract is to provide the student with an understanding of the AAR's Residential Resale Real Estate Purchase Contract. Understanding the fine print in this form is imperative when confronted with questions from buyers and sellers. Therefore, each of the 9 sections of the AAR contract will be thoroughly reviewed.

Course Documents and Reference Materials In order to pass this class and receive your Educational Certificate, the student must complete all sessions by reading the materials online and completing the quizzes at the end of each session. After all sessions have been completed, the student can then proceed to take their Final Exam, which consists of 25 questions based on the completed sessions. You must pass the Final Exam with a score of 80%, which will indicate that you have read and completed your assignments. You can retake the final until you pass. Once you pass your Final Exam, you can then click on the Certificate Link and

receive your Educational Certificate for 3 hours of credit in Contract Law. | ||||||||||||

|

AAR Residential Transaction Forms At the conclusion of this course, the student will be able identify and use the appropriate AAR FORM that is commonly used in conjunction with the AAR Residential Purchase Contract. Forms reviewed in this course: In order to pass this class and receive your Educational Certificate, the student must complete all sessions by reading the materials online and completing the quizzes at the end of each session. After all sessions have been completed, the student can then proceed to take their Final Exam, which consists of 25 questions based on the completed sessions. You must pass the Final Exam with a score of 80%, which will indicate that you have read and completed your assignments. You can retake the final until you pass. Once you pass your Final Exam, you can then click on the Certificate Link and

receive your Educational Certificate for 3 hours of credit in Contract Law. |

|

Delivering the Standard of Care At the conclusion of this course the student will be able to define the duties imposed by the standard of care. Also, the student will be able to identify the sources from which the standard of care is created. In addition the student will be able to describe the consequences for failure to meet the standard of care. The student will also be able to identify certain specific statutes, Commissioner’s Rules and NAR Code Articles and Standards of Practice that apply to certain situations.

In order to pass this class and receive your Educational Certificate, the student must complete all sessions by reading the materials online and completing the quizzes at the end of each session. After all sessions have been completed, the student can then proceed to take their Final Exam, which consists of 25 questions based on the completed sessions. You must pass the Final Exam with a score of 80%, which will indicate that you have read and completed your assignments. You can retake the final until you pass. Once you pass your Final Exam, you can then click on the Certificate Link and

receive your Educational Certificate for 3 hours of credit in Commissioner's Standards. | ||||||||||||||||

|

BMC #1 - Statutes and Rules You don't have to be a broker to take this course. The objectives of this course is to

provide the student with an understanding of the Commissioner's Rules, Substantive Policy Statements, Arizona Revised Statues and contracts and employment agreements as it relates to the broker's real estate business.

In order to pass this class and receive your Educational Certificate, the student must complete all sessions by reading the materials online and completing the quizzes at the end of each session. After all sessions have been completed, the student can then proceed to take their Final Exam, which consists of 25 questions based on the completed sessions. You must pass the Final Exam with a score of 80%, which will indicate that you have read and completed your assignments. You can retake the final until you pass. Once you pass your Final Exam, you can then click on the Certificate Link and

receive your Educational Certificate for 3 hours of credit in Commissioner's Standards. | ||||||||||||||

|

BMC #2 - Broker Policies You don't have to be a broker to take this course. At the conclusion of this course the student will be able to identify and implement the required elements of reasonable supervision with the people he or she employs; identify and implement measures to systematize effective risk management in the company; use the ADRE model office policy manual to properly and effectively structure policies and procedures in their company; and develop and utilize an effective Independent Contractor Agreement (ICA) in their real estate company.

In order to pass this class and receive your Educational Certificate, the student must complete all sessions by reading the materials online and completing the quizzes at the end of each session. After all sessions have been completed, the student can then proceed to take their Final Exam, which consists of 25 questions based on the completed sessions. You must pass the Final Exam with a score of 80%, which will indicate that you have read and completed your assignments. You can retake the final until you pass. Once you pass your Final Exam, you can then click on the Certificate Link and

receive your Educational Certificate for 3 hours of credit in Commissioner's Standards. | ||||||||||||||

|

BMC #3 - Supervision You don't have to be a broker to take this course. At the conclusion of this course the student will be able to identify and understand the concepts of broker supervision in risk management and implement effective and prudent measures to ensure it, including supervising licensees; delegation of authority; unlicensed activities; understanding the standard of care concepts; marketing and advertising; record keeping requirements; and selecting and working with the Errors & Omissions insurance providers.

In order to pass this class and receive your Educational Certificate, the student must complete all sessions by reading the materials online and completing the quizzes at the end of each session. After all sessions have been completed, the student can then proceed to take their Final Exam, which consists of 25 questions based on the completed sessions. You must pass the Final Exam with a score of 80%, which will indicate that you have read and completed your assignments. You can retake the final until you pass. Once you pass your Final Exam, you can then click on the Certificate Link and

receive your Educational Certificate for 3 hours of credit in Commissioner's Standards. | ||||||||||||||

|

HP12-c Calculator Course

HP12-c Calculator REQUIRED Summary of Basic Concepts 1. On/Off HP-12C Keystroking - Summary of Lessons Lesson #1Compounding one investment THIS WILL CALCULATE:

How much will your property be worth in so many years?

Lesson

#2

Compounding a series THIS WILL CALCULATE:

How much money you will have if you make regular installments over a period

of time?

Lesson

#3

Sinking fund THIS WILL CALCULATE:

How much to set aside each period if you need so much money in the future?

Lesson

#4

Discounting one investment THIS WILL CALCULATE:

If you have an investment that you know what the future sum will be (or

an estimate of what it will be) and you want to determine how much to

pay for it to earn a desired return.

Lesson

#5 Discounting a series THIS WILL CALCULATE:

If you have an investment that will pay in equal periodic installments

and you want to determine how much to pay for it to earn a desired return.

Lesson

#6 Discounting a series with balloon THIS WILL CALCULATE:

If you have an investment that you know what the future sum will be (or

an estimate of what it will be) and you also receive periodic payments

along the way, and you want to determine how much to pay for it to earn

a desired return.

Lesson

#7 Rate of Return on Investment THIS WILL CALCULATE:

If you know the loan amount and the periodic payments, this will calculate

your return on investment.

Lesson #8 THIS WILL CALCULATE:

If you loan money and receive equal periodic payments and a lump sum balloon

payment, this will calculate your rate of return.

Lesson #9 THIS WILL CALCULATE:

If you know the loan amount and the annual interest, this will calculate

your periodic payment.

Lesson

#10

Remaining balance on a loan THIS WILL CALCULATE:

If you know your loan information, this will calculate your remaining

balance or balloon payment.

HP-12C Keystroking - Advanced Concepts Lesson #1Internal Rate of Return THIS WILL CALCULATE:

Rate of return for uneven cash flows.

Lesson

#2

Net Present Value THIS WILL CALCULATE:

How much to pay for an investment with uneven cash flows.

In order to pass this class and receive your Educational Certificate, the student must complete all sessions by reading the materials online and completing the quizzes at the end of each session. After all sessions have been completed, the student can then proceed to take their Final Exam, which consists of 25 questions based on the completed sessions. You must pass the Final Exam with a score of 80%, which will indicate that you have read and completed your assignments. You can retake the final until you pass. Once you pass your Final Exam, you can then click on the Certificate Link and receive your Educational Certificate for 3 hours of credit in General. |

|

Who may take BMC Courses? SALESPERSONS AND NON-DELEGATED ASSOCIATE BROKERS may also take the BMC courses which will apply towards your Commissioner's Standard credit. If you have more than 3 hours in Commissioner's Standard, you can also use these courses as GENERAL CREDITS. (Remember - general credits are any course you have not previously taken.) Who is required to take BMC Courses? DESIGNATED BROKER & DELEGATED ASSOCIATE BROKEREffective on and after January 1, 2013, at least 9 hours of credit in the Commissioner’s Standards category must be of the Broker Management Clinic courses (consisting of BMC #1, BMC #2, and BMC #3) if you are an active status designated broker (which includes self-employed brokers) or delegated associate broker with written authorization to act on behalf of the designated broker by reviewing and initialing contracts and similar instruments pursuant to A.R.S. § 32-2151.01(G). |

|

|

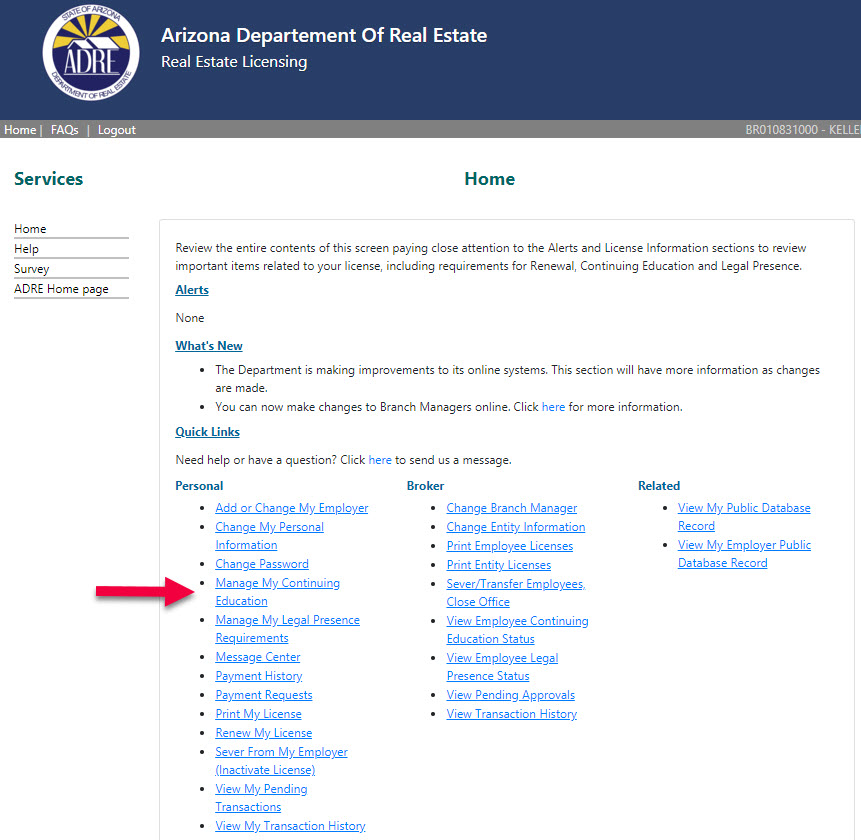

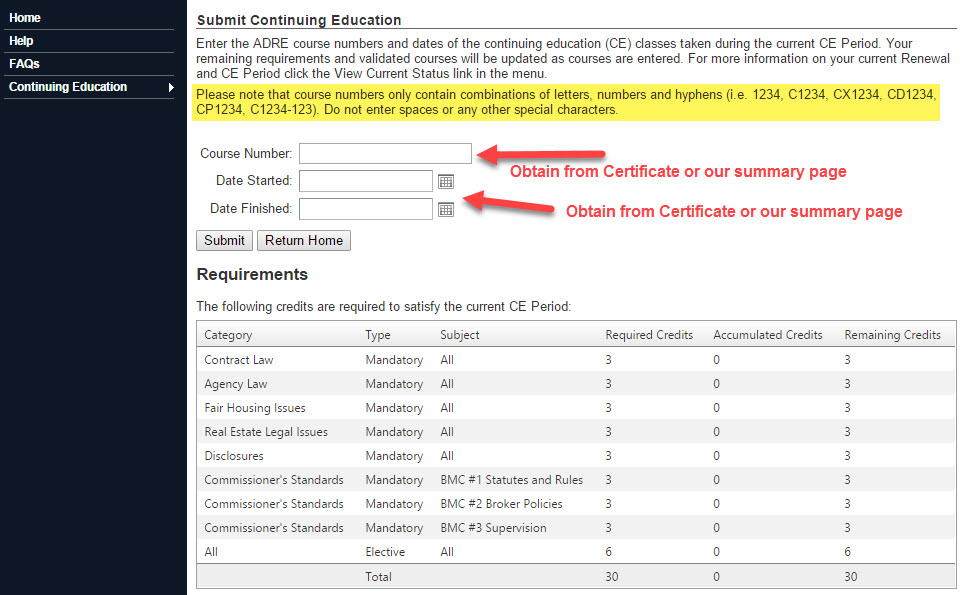

How to renew your license online at ADRE STEP 1 Go to ADRE's website and login to your account. https://az.gov/webapp/dre/

Click on Continuing Education on Left Menu and then Submit Courses This can be done as you finish each course or after you finish all of your courses.

The above is an example for brokers needing 30 hours. If you need 24 hours, the Required Credits column will indicate 24 hours.

Answer the questionnaire

STEP 5 Pay your renewal fee

|

Arizona Department of Real Estate

Continuing Education Requirements

Salesperson & Non-Delegated Associate Broker — 24 hours

Designated Broker & Delegated Associate Broker — 30 hours

| If you need 24 hrs. to renew — One course in each of 6 categories: Fair Housing Issues, Disclosure, Agency Law, Legal Issues, Contract Law, Commissioner's Standards. A new required course - "Deed Fraud, Water, Firewise", which is a General credit. Then any other 1 course you haven't already taken. |

| If you need 30 hrs. to renew — One course in each of 5 categories: Fair Housing Issues, Disclosure, Agency Law, Legal Issues, Contract Law. All 3 BMC Courses (BMC#1, BMC#2, BMC#3) and then a new required course - "Deed Fraud, Water, Firewise", which is a General credit. Then any other 1 course you haven't already taken. |

| Deed Fraud, Water, Firewise course is not required until January 1, 2025, however, we are including this course in our packages so you can take it now. |

| When can you take your courses and renew at ADRE? — You can take your courses ANYTIME during your current licensing period; not before. You don't have to wait until the last minute! You can report your courses to ADRE anytime during your licensing period but ADRE will not allow you to renew your license and pay your fees until 90 days before your license expires. |

|

Agency Duties & Obligations The objective of this course is for the student to get an overview of an agent's duties and obligations to clients and customers in Arizona. Areas covered will be agency relationships and how they are created and terminated; duties in the agency relationships; the agency disclosure process and the broker and salesperson relationship.

Course Documents and Reference Materials In order to pass this class and receive your Educational Certificate, the student must complete all sessions by reading the materials online and completing the quizzes at the end of each session. After all sessions have been completed, the student can then proceed to take their Final Exam, which consists of 25 questions based on the completed sessions. You must pass the Final Exam with a score of 80%, which will indicate that you have read and completed your assignments. You can retake the final until you pass. Once you pass your Final Exam, you can then click on the Certificate Link and

receive your Educational Certificate for 3 hours of credit in Agency Law. | ||||||||||||

| ||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||

|

NAR CODE OF ETHICS Delivering the Standard of Care This course meets all NAR Ethics Course requirements for cycle ending December 31, 2021 and also gives you 3 credit hours of Commissioner's Standard for ADRE. At the conclusion of this course the student will be able to define the duties imposed by the standard of care. Also, the student will be able to identify the sources from which the standard of care is created. In addition the student will be able to describe the consequences for failure to meet the standard of care. The student will also be able to identify certain specific statutes, Commissioner’s Rules and NAR Code Articles and Standards of Practice that apply to certain situations.

THIS COURSE ALSO WILL GIVE YOU A 3 HOUR CREDIT FOR ADRE'S COMMISSIONER'S STANDARD. In order to pass this class and receive your Educational Certificate, the student must complete all sessions by reading the materials online and completing the quizzes at the end of each session. After all sessions have been completed, the student can then proceed to take their Final Exam, which consists of 25 questions based on the completed sessions. You must pass the Final Exam with a score of 80%, which will indicate that you have read and completed your assignments. You can retake the final until you pass. Once you pass your Final Exam, you can then click on the Certificate Link and

receive your Educational Certificate for 3 hours of credit in Commissioner's Standards. | ||||||||||||||||

|

NAR CODE OF ETHICS

This course is only required if you are a member of the National Association of REALTORS® (NAR)

|

|

Deed Fraud, Water, Firewise

3 hours credit - REQUIRED General Real Estate

In order to pass this class and receive your Educational Certificate, the student must complete all sessions by reading the materials online and completing the quizzes at the end of each session. After all sessions have been completed, the student can then proceed to take their Final Exam, which consists of 25 questions based on the completed sessions. You must pass the Final Exam with a score of 80%, which will indicate that you have read and completed your assignments. You can retake the final until you pass. Once you pass your Final Exam, you can then click on the Certificate Link and

receive your Educational Certificate for 3 hours of credit in General Real Estate. | |||||||||||||||

| 9 hours (3 courses) – $50 18 hours (6 courses) – $70 24 hours (8 courses) – $120 [Save $30] → $90

|

|

Click on Package or Individual Courses below for Information:

Individual 3-hour Courses

|

| If you need 24 hrs. to renew — One course in each of the first 6 categories: Fair Housing Issues, Disclosure, Agency Law, Legal Issues, Contract Law, Commissioner's Standards. A required course - "Deed Fraud, Water, Firewise", which is a General credit. Then any other 1 course you haven't already taken. You have the option to select our package or any 8 courses below: |

| If you need 30 hrs. to renew — One course in each of the first 5 categories: Fair Housing Issues, Disclosure, Agency Law, Legal Issues, Contract Law. All 3 BMC Courses (BMC#1, BMC#2, BMC#3) and then a required course - "Deed Fraud, Water, Firewise", which is a General credit. Then any other 1 course you haven't already taken. You have the option to select our package or any 10 courses below: |

| When can you take your courses and renew at ADRE? — You can take your courses ANYTIME during your current licensing period; not before. You don't have to wait until the last minute! You can report your courses to ADRE anytime during your licensing period but ADRE will not allow you to renew your license and pay your fees until 90 days before your license expires. |

| ADRE License Renewal Requirements ADRE Fees ADRE Tutorial to Renew your License |

| Renew online at ADRE's website once you finish your courses |

| AZREB |

| Arizona Real Estate Business |

| iRealtySchool.com |

| Arizona Department of Real Estate |

| Approved School #S01-0002 |

| Copyright 2025, iRealtySchool.com |

| All rights reserved. |

| A Division of REcentral, LLC |